40+ mortgage interest rates federal reserve

We Offer Competitive FHA Rates Fees. A variety of important mortgage rates increased over the last seven days.

Assuring Your Financial Customers As Interest Rates Increase

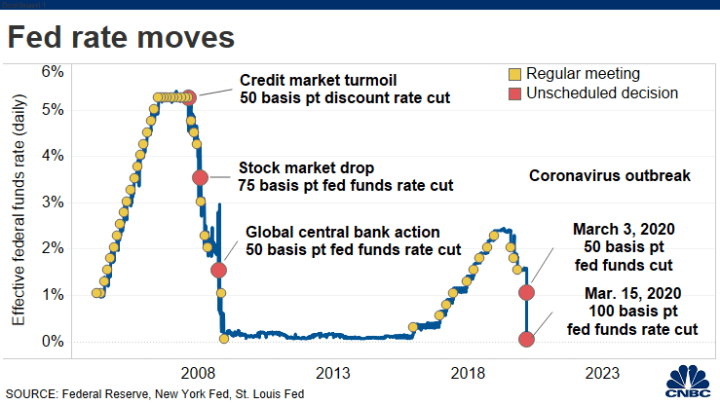

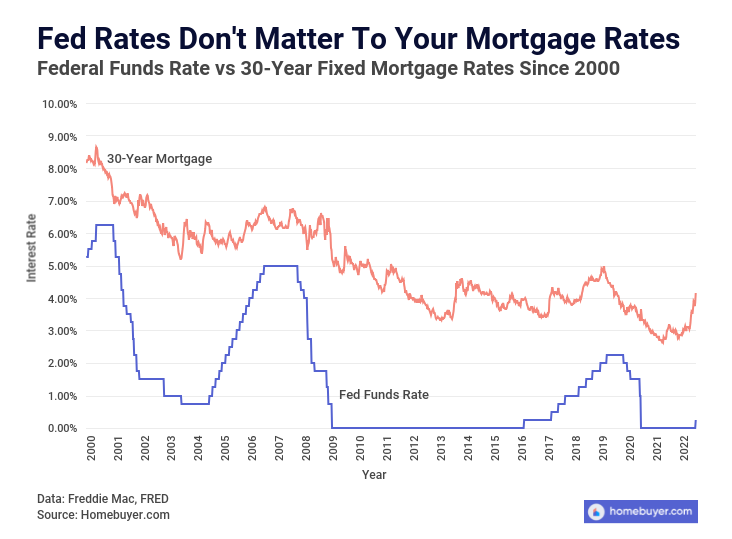

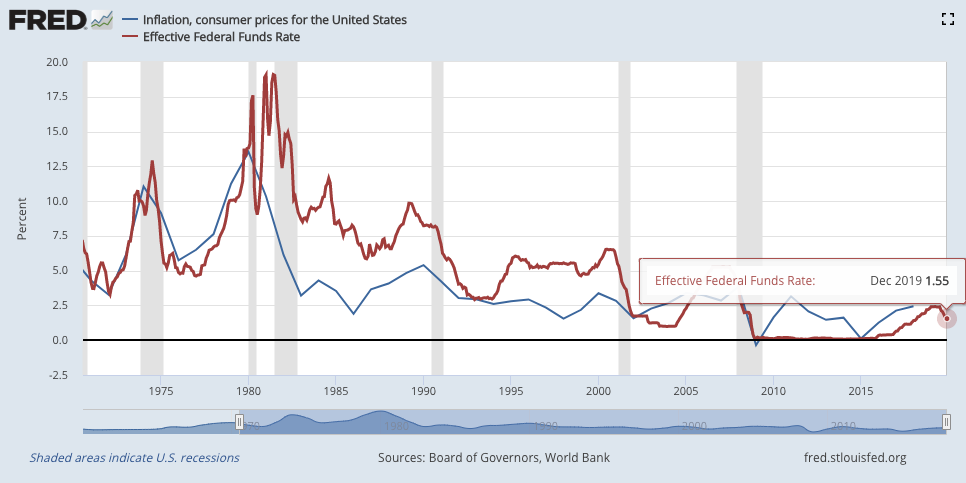

Web The fed funds rate affects short-term loans such as credit card debt and adjustable-rate mortgages which unlike fixed-rate mortgages have a floating interest.

. Ad Farm Land Loans Open Opportunities For Years To Come. Web The interest rate on federal student loans taken out for the 2022-23 academic year already rose to 499 up from 373 last year and 275 in 2020-21. Web 13 hours agoThe Federal Reserve directly controls the shortest term lending rates.

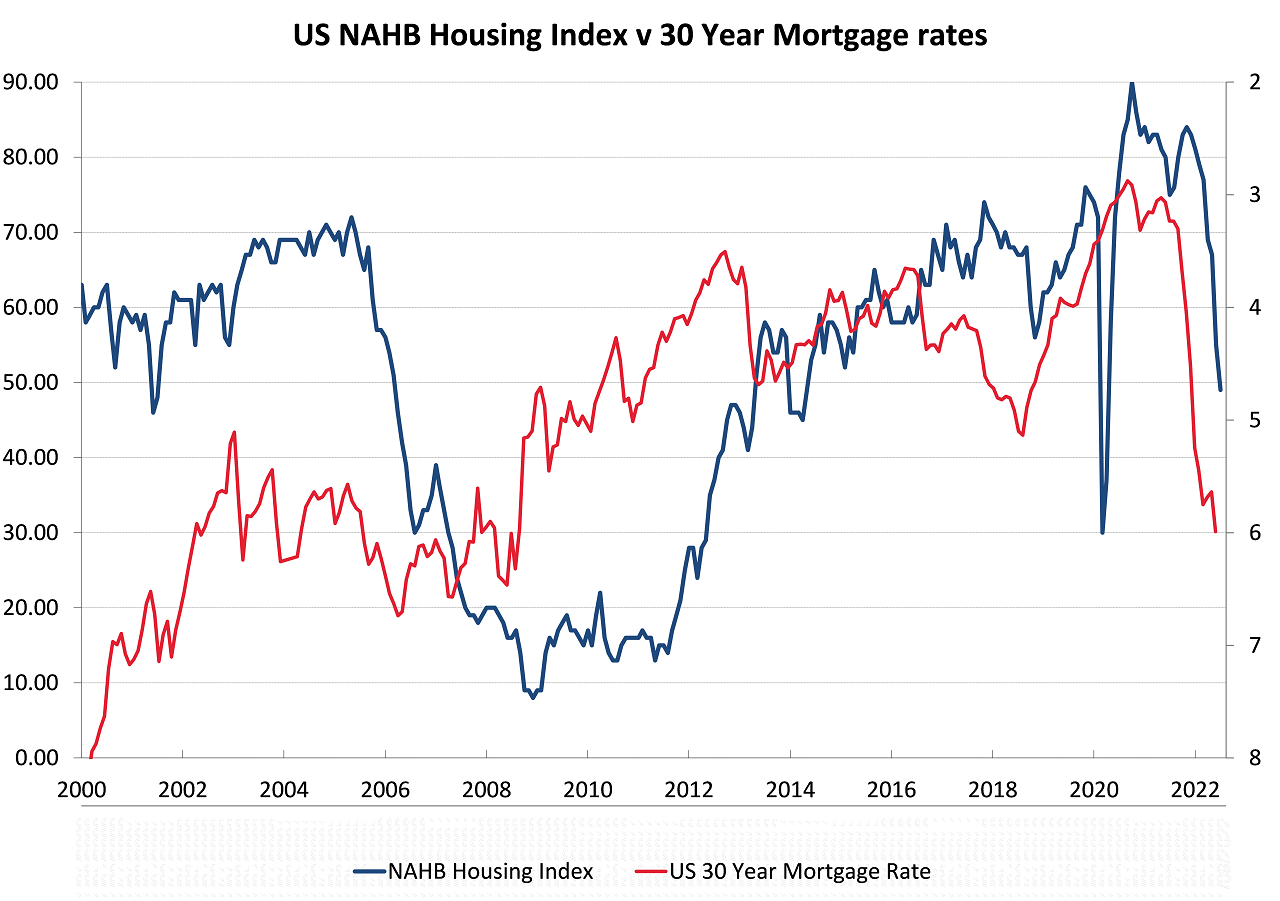

Nearly risk-free investments like Treasuries now yield as much as 5 and that rate seems likely to. Ad Automatically monitor mortgage loan changes throughout the lifecycle of the loan. Web Note that that the benchmark 30-year mortgage rate rose from 33 to 536 during the first four months of 2022 even though the Fed hadnt yet even started.

Web Updated Feb. Web The Fed is still raising interest rates and unwinding 95 billion worth of Treasury and mortgage-backed securities MBS each month. Ad Compare Mortgage Options Get Quotes.

Retailers and other consumer companies fell amid concerns about rising interest rates. 22 2023 at 517 pm. Mortgage rates were set to test multiyear highs.

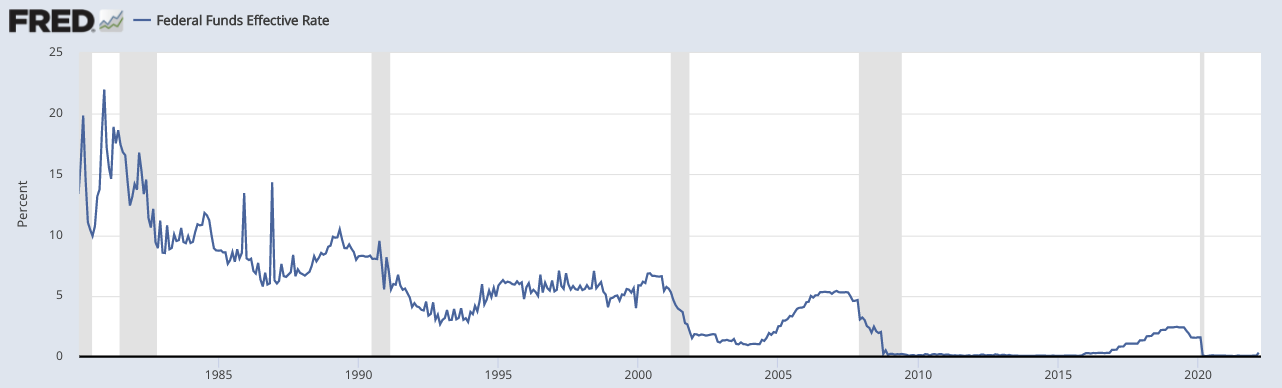

Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year. Get Instantly Matched With Your Ideal Mortgage Lender. What More Could You Need.

Lock Your Rate Today. What More Could You Need. Web 2 days ago15-year fixed-rate mortgages.

VA Loan Expertise and Personal Service. Contact a Loan Specialist. Federal Reserve to raise interest rates three more times this year lifting their.

The groups policy rate is now set at a range of. Compare Top Home Equity Loans Save Today. This rate is much higher than the 0 to 025 target it was aiming for in July 2021.

MBS are a kind of bond that. Get Started Now With Quicken Loans. The average rate for a 15-year fixed mortgage is 618 which is an increase of 17 basis points from seven days ago.

A tool for mortgage lenders to calculate mortgage pricing options all within Encompass. Web The HELOC rate has hovered around 43 to 44. Web Board of Governors of the Federal Reserve System The Federal Reserve the central bank of the United States provides the nation with a safe flexible and stable.

Comparisons Trusted by 55000000. Get Your Quote Today. Ad 10 Best Home Loan Lenders Compared Reviewed.

Web 2 hours agoMortgage rates currently are somewhere in the 625 range which may feel pretty good if youre a Baby Boomer and remember when rates were in the 18 range. By September 2022 the average rates for 30- and 15. Bank We Offer Helpful Tools and Resources For Navigating FHA Home Loans.

Ad Reviews Trusted by 45000000. Mortgage rates are dictated by longer-term bonds in the open market but traders of. Ad Compare Mortgage Options Get Quotes.

Set Your Operation Up For Success By Financing Your Farm Loan With FBN. Trusted VA Loan Lender of 300000 Proud Veteran Homeowners Nationwide. The Fed funds rate has been the same throughout.

Web 1 day agoFeb 22 Reuters - The average interest rate on the most popular US. Web 39 rows Weekly monthly and annual rates are averages of business days unless. Lock In Your Low Rate Now.

Web As the Fed hiked interest rates 30-year fixed-rate mortgages shot up in 2022 as the Fed hiked interest rates. Web The Feds current target for the federal funds rate is 15 to 175. Mortgage rates nearly double.

At the start of last year average 30-year fixed-mortgage. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. Get Started Now With Quicken Loans.

The first is its direct control of short. Reputable and Trusted Lenders. Web Feb 17 Reuters - Goldman Sachs and Bank of America said they expect the US.

Web How The Federal Reserve Generally Affects Interest Rates The Fed holds two main tools it uses to influence interest rates. The prime rate has been 325 since April 2020. Web 35 minutes agoTheir low mortgage rates mean theyre borrowing at 3.

Web After the Federal Reserve began raising interest rates in March 2022. Web Since the beginning of the pandemic the Federal Reserve has been buying 40 billion per month in mortgage-backed securities MBS. Receive 1000 Off On Pre-Approved Loans.

Home loan rose last week to its highest since November as bond markets took fright that the.

Mortgage Rates Rise With Positive Economic News On Horizon National Mortgage News

Federal Reserve Approves Fourth Rate Hike To Combat Highest Level Of Inflation In 40 Years Builder Magazine

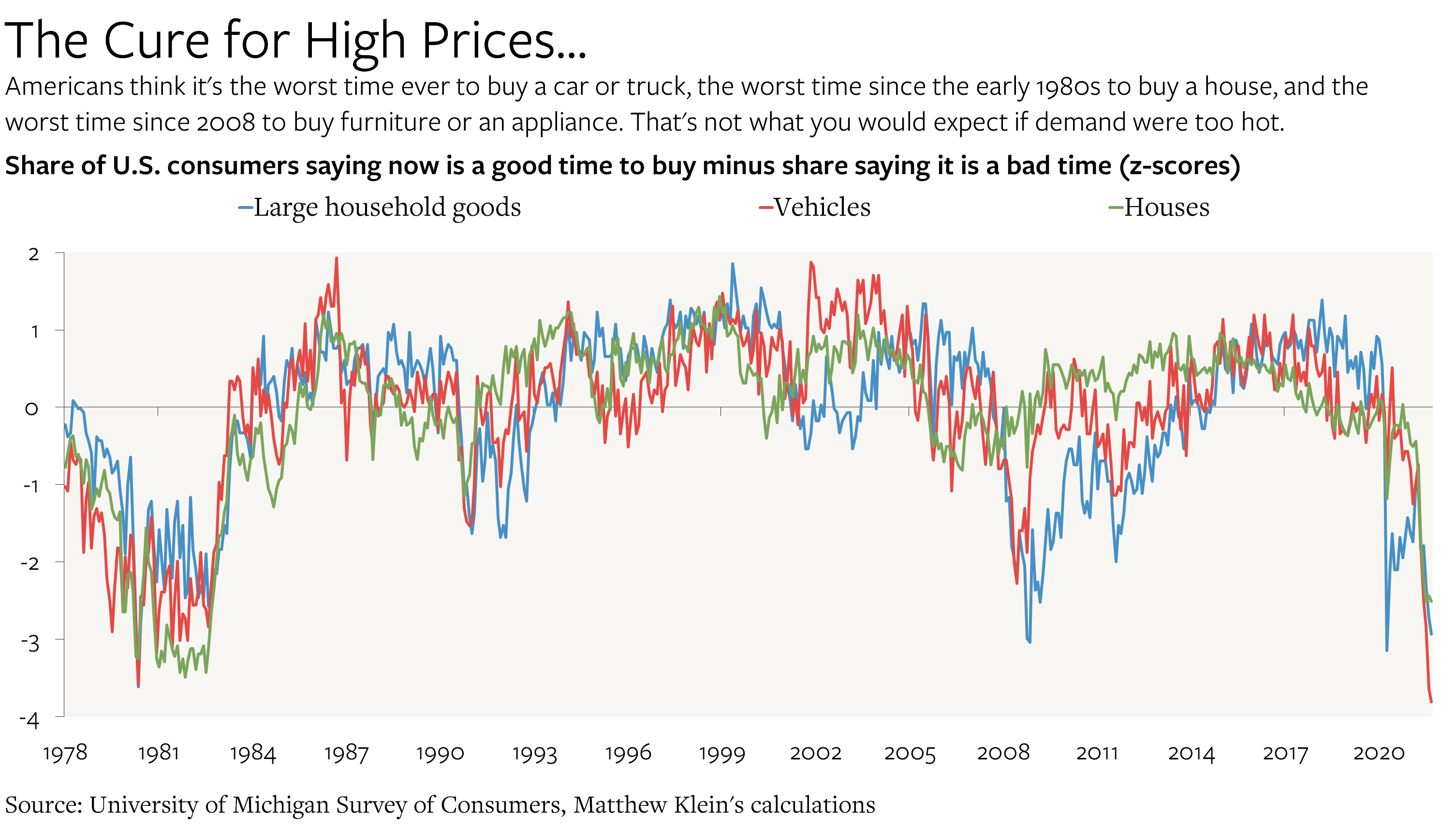

The Case For Patience On Inflation By Matthew C Klein

Us Mortgage Rates Hit 21 Year High As Fed Action Weighs On Housing Sector Us Economy The Guardian

Fed Holds Rates Near Zero Here S What That Means For Your Wallet

The Federal Reserve S Effect On Mortgage Rates What To Know Fox Business

Mortgage Rates And The Fed Funds Rate Updated 2023

Dissecting What Will Drive Us Inflation Down Interest Co Nz

80 Of House Price Appreciation Since 1990 Was Due To Falling Mortgage Interest Rates

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

5lstx2riselu3m

What Will Surging Mortgage Rates Do To Housing Bubble 2 Wolf Street

Mortgage Rates Rise To Highest Levels Since Start Of Pandemic

Why Mortgage Interest Rates Will Go Down In 2023 In Texas

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Rates Approach 5 As Fed Tightens And Inflation Rattles Bond Markets

How To Navigate Paradigm Shifts In Financial Markets Daytrading Com